Customer Verification

Financial services are always at highest to risk of fraud. RegTech reliable and digitally evolved customer verification services are best tool to prevent fraud. Our Fintech Correspondants are well equipped with skill and technology to detect fraud on the ground.

- ✓ Original Seen and Verified (OSV)

- ✓ Contact Point Verification

- ✓ Permanent address visit for skip tracing

Aadhaar Verification

It is an excellent API for paperless KYC purposes in which all the details captured and being verified with details obtained from the UIDAI server. It is based on the specially designed algorithm, capturing real-time detail from the customer's aadhar card.

Pan Verification

The best feature of this API is instantaneous verification response time as it captures all the details such as PAN number or image within seconds and matches with the details obtained from National Depository Securities Ltd. (NSDL)

Driving License Verification

If there is a need for driving license verification, it is the best for yse by government or insurace companies, which provides an accurate result than physical verification. It captured all the details immediately and matched with factual data obtained from the Ministry of Road Transport & Highways server.

Voter Id Verification

The primary input for verifying voter id is the EPIC number, which works as the input. After collection all the details, real-time verification occurs by checking finding equivalence between authenticated data from the Election Commission of India and user-filled data.

Passport Verification

Its process is based on the unique algorithm designed as an MRZ algorithm. According to the process, the system generated the MRZ code based on the input and matchded it with the client's data. All the details will be verified based on details from the Passport Seva Kendra portal.

Bank Account Verification

customer's bank details can be verified with accuracy by using the details such as account number, IFSC code, or cheque image. All the details will be matched with the details obtained from the bank's IMPS network.

Know the Customer's Authenticity With Our e-KYC SERVICE.

SEBI registered banking and financial services companies who wants to perform the transaction for investing in the financial market has to follow a process of "Know your client" details of which can be verified and validated through a KRA - 'KYC Registration Agency'. RegTech API service ensure that "Know your client" information is extracted once Pan Card Number and Date of birst is provided.

Reports and Analytics

Point to point analytics for informed decision making and audit-ready reports.

Data Science/AI

AI calculations and algorithms for early fraud detection

Audit and Compilance

Processes consistent with government and industry models, and reports prepared for comprehensive audits

Security

Invulnerable information security and complete lawful and statutory compliance.

Speed up the KYC process With Our Video-KYC SERVICE.

RegTech Video KYC helps enterprises speed-up customer on-boarding process by automating the document collection and verification processes. RegTech Video KYC includes a live video meeting with a client that builds up their presence during the KYC process, confirming their identity through the RegTech video KYC as per the government ID card and records it with the end goal of review and consistency.

The procedure for video KYC can be done anywhere even in the comfort of your own home! All you need is a pc, cell phone, or tablet with a working internet connection Customer onboarding process is extremely fast and reliable. It can eliminate 90% cost over physical verifications process.

Digital Solution

KYC can be possible in the comfort of your home

Accuracy

Crosscheck from Government issued ID

Fast and Reliable

Swift on boarding process

Cost effective

Over physical verification process

Get Your KYC Done in Minutes With RegTech e-Sign

We provide a e-sign OTP based signature service, authenticating the Aadhar holder via Aadhar based e-KYC service.

Our eSign API has been designed to replace physical paper based signature to sign any document.

This helps signatory to sign a digital document using Aadhar or PAN based OTP authentication.

Cost effective, secure and easy to integrate.

API's & SDK's

Consistently integrable APIs and SDKs for realtime results

WorkFlows

A workflow consists of an orchestrated and repeatable pattern of activity, enabled by the systematic organization.

Digital Solution

KYC can be possible in the comfort of your home

Accuracy

Crosscheck from Government issued ID

RegTech Offline Aadhaar KYC for enterprises

KYC Aadhaar is the paperless Aadhaar Offline based KYC arrangement, for enterprise searching for an option for Aadhaar based eKYC and for the individuals who are attempting to automate their client on-boarding and confirmation process utilizing their application or web-based interface.

How it works

Client downloads offline Aadhaar from UIDAI and shares it with you which validates and confirms customers identity

Privacy

No biometrics required for such verification

Security

It is digitally signed by UIDAI to verify authenticity and detect any tampering

Inclusion

Aadhaar Paperless Offline e-KYC is voluntary and Aadhaar number holder driven

Accuracy

Crosscheck from Government issued ID

Aadhar Maasking

RegTech Data Masking API covers the Aadhaar Numbers to make Aadhaar cards usable as Officially Valid Documents (OVDs)

It is the best example of data masking API compared to the other running in the market. The Aadhaar masking provides the full security to the UIDAI information printed on the card as it conceals the first 8 digits and reveals only the last four digits, which is allowed by the RBI as OVD.

This image can be stored for your KYC records to get consistent with the most recent guidelines.

Precisely Accurate

Real time

Trusted

Supports all image formats

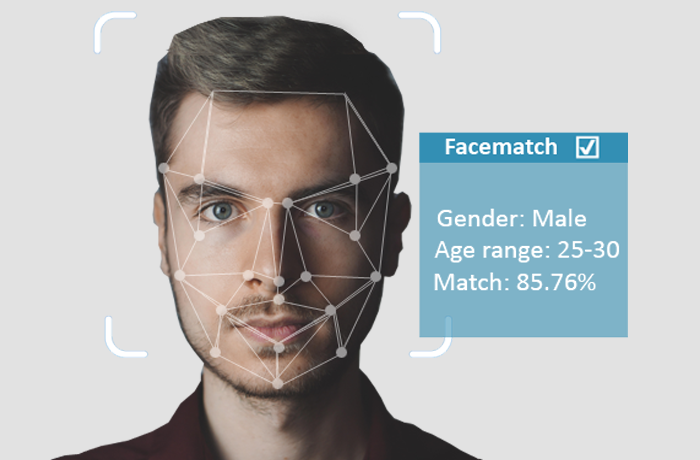

Face Match

Be assure that two pictures are of a similar individual with the best in class RegTech Face Match algorithm using artificial intelligence and machine learning. It verifies, analyses and identifies faces in real-time.

RegTech algorithm excels in every challenging situation including light and angle variability, blur and pixelation, age, and gender.

RegTech empowers enterprises who need face match that is accurate in testing situations to give unrivalled degrees of security, ongoing execution, and can be used in any given conditions.

RegTech Face match helps in protecting individuals and organisations against frauds and mitigations where an attacker is using video, images, or masks to spoof a system 100% Accuracy Industry-leading performance with challenging angles and lighting conditions

Well Designed

Easy to use interface

Age Estimation

Estimates the age of the user

Emotions Detection

Detects through facial expression

Affordable

Usage-based pricing

Easily Handle Recurring Payments With NACH Debit

Handle your recurring payments and schedule your premium payments easily using our e-Nach Service.

Our simple online process helps customers to keep track of individual premium payments.

RegTech is well reputed in providing easier, cheaper, faster and safer paperless transaction between banks and customers.

Our Nach platform provides simple dashboards, rest APIs and mobile SDKs for easy management of subscriptions, mandates, payments, and settlements.

We help customers to create plans for variable amounts and ad-hoc payments. Our e-Nach and e-Mandates do not involve cheques, cash, and digital wallets.

API's & SDK's

Consistently integrable APIs and SDKs for realtime results

WorkFlows

A workflow consists of an orchestrated and repeatable pattern of activity, enabled by the systematic organization.

Audit and Compilance

Processes consistent with government and industry models, and reports prepared for comprehensive audits

Security

Invulnerable information security and complete lawful and statutory compliance.

Verified Customer Acquisition

CIN LLPIN Validation

It is used to extract the details such as company name, address, director's details, and the annual return date. All the details are verified using the data obtained from the Ministry of Corporate Affairs.DIN Verfication

The director or director's details can be verified using this API based on data obtained from the Ministry of Corporate Affairs.ITR Verfication

A great option to verify the ITR details where PAN number works as the input, and in the form of output, it produces details associated with PAN. The details verified using the data obtained from the GST Portal.GSTIN Verification

It is used to verify GST details by capturing the GST certificate image or GSTIN number, which produces the company name, address, filling status, and company type.Shops and Establishment

Here, inputs required are shop establishment id or S&E certificate image. All the details are verified by obtaining the data extracted from the portals of various states.Vehicle Verification

Basic Vehicle RC verification

It is used to verify the RC details by matching the details obtained from the Ministry of Road, Transport, and highways.Advance Vehicle RC Verfication

The advanced version of the RC verification in which complete details are extracted by only providing RC number, engine number, and chassis number.Key Features

- ✓ Error-proof documentation

- ✓ Fraud detection & reporting

- ✓ Real-time verification & validation

- ✓ Analytics based on AI/Machine Learning

- ✓ Geotagging & date-time stamp

- ✓ End to end data encryption

- ✓ Unique payment collection method

- ✓ Impactful Dashboard

- ✓ Efficient report creation and data collection

Perks

- ✓ Plug 'N' Play approach

- ✓ Fast Customer onboarding

- ✓ Cost effective

- ✓ Time effective

- ✓ Real-time Scheduling

- ✓ Scalable

- ✓ Compilance with Mandate

- ✓ Platform Independent

Customer Verification Brouchure

Contact Us Now

Feel free to get in touch with us, our team will be happy to assist